What to-do and Say During Market Volatility

The markets are experiencing some volatility, and you may be wondering how to keep your clients informed about market changes and what you can do to help them. You may also be wondering whether it’s appropriate or even necessary to communicate during volatile times like these. The answer is both yes and no. It depends on your role as an advisor and the type of client you work with.

Some volatility is natural and normal.

While it’s true that market volatility can be unnerving, it’s also normal and not inherently bad. Volatility is a fact of life in the financial world and there are many possible explanations for why it occurs.

The first thing to remember is that market volatility is a natural state of affairs for any economy or market. Stability is an idealized concept: every system tends toward equilibrium, but there are always forces at work trying to upset that balance. In other words, your investments will never remain completely constant – they will always fluctuate in value over time. The trick is knowing how much they’ll fluctuate and when those fluctuations will happen so you can make informed decisions about how best to handle them (which we’ll get into later).

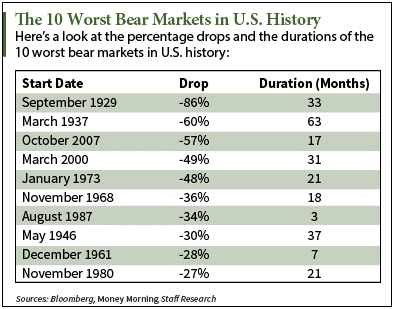

Bear markets don’t last forever. History shows us that buying during those time periods pays off. However the average bear market is a multi-year event and requires a plan- for trading and client communications. Below is a chart of the biggest bear markets.

A Plan for Effective Communication

In times of volatility, it’s important to keep your clients informed and in the know. Here are some tips for communicating effectively during market volatility:

Be proactive in your communication. Have a plan in place that you can act on quickly when needed. Consider having a pre-written statement ready to go if there is an issue that arises.

Be consistent in all communications. Your message should remain consistent across all channels, whether it be email or phone call (or both). If there is an update or change in direction, be sure that everyone has been notified of this change so they know what they should be telling clients/customers who reach out with questions or concerns after hearing about news from other sources first hand instead of from you directly!

Be honest with yourself about how much information you want/need to share publicly versus privately- and then stick with it! The last thing anyone wants during volatile market conditions is uncertainty about what exactly may happen next based on what someone else thinks might happen next…

How to Craft Your Message

To craft an effective message, the first step is to make sure the information you’re sharing is relevant and interesting to your client. That means:

Keep it short. The shorter, the better. Avoid unnecessary details or explanations for which you don’t have time or space in a communiqué. Be concise!

Use plain language. You can speak in full sentences and paragraphs as long as they are clear and concise; jargon is not necessary if what you have to say is important enough to say at all! If possible, try using active voice instead of passive voice (e.g., “I will call you tomorrow morning at 9 am” rather than “We will be calling you tomorrow morning at 9 am). This helps keep readers engaged with what they’re reading since active verbs tend suggest action while passive verbs tend suggest passivity.)

Make sure it’s relevant- not just for them but also for their clients’ clients downline who might need this information too! A message that says “we’re closing our doors” without any context doesn’t mean anything unless someone knows why we would close our doors!”

When to Communicate

The market is unpredictable and volatile, so it’s important to communicate with clients as soon as possible. Don’t wait until the market has already dropped by 20 percent before telling your clients what’s going on. This can cause them to panic and make rash decisions, which will only exacerbate their losses.

Regularly communicate with your clients via email, phone calls or text messages to inform them about changes in the market or any other relevant news that may affect their investments (such as a new product launch). It’s best to keep these communications brief and easy-to-understand- you don’t want your client getting distracted by complicated information that doesn’t add value for them!

What to Say

When you’re talking to an investor who is nervous about the market, it’s important to remember that their emotions are running high. They may not be thinking clearly and may try to make rash decisions. It is up to you as a financial advisor to help them stay grounded and make sure they don’t do anything dangerous or costly.

The best way for advisors to communicate with clients during market volatility is by being transparent, offering help if needed, and being empathetic while not over-promising any opportunities of quick gains. As a result, you will build trust between yourself and your client base which will allow them to feel more confident in coming back later when things get better again (which they always do).

Where to Say It

Now that you understand why and how to communicate during market volatility, where should you say it?

Website/blog: If you have a blog, then it’s a good place to keep your audience updated on the latest news. Consider adding a blog post about your company’s strategy for dealing with market volatility in the future. You can also update any social media accounts that link back to your website so that people can see this information there as well.

Email: Many companies send out emails when they have important announcements or updates for their customers or investors- this is an excellent way to keep everyone up-to-date on what’s going on with the business during volatile times. Email may not be ideal if many people are checking their phones instead of their inboxes, though; make sure that those who need access can find it easily!

Social media: Think about what platforms your audience uses most often and share content accordingly (for example, Twitter might work better than Facebook). This will allow them access without having all of their notifications flooded by different sources of alerts at once – which may cause some stress due to too much information coming through quickly while they’re trying relax and unwind after work hours.

Webinar or eBook: If people are panicking a recorded webinar or eBook is great for explaining complex movements and relative historical periods. Not everybody understands how rising interest rates impacts bonds. Explaining your approach and answering common questions is great for defining you as a thought leader.

Keep clients abreast of market changes and expand your outreach.

- Stay prepared to answer questions.

- Be ready to explain your strategy, what you’re watching and why you are not selling at the moment.

- Reinforce the importance of diversification and rebalancing, which is key to helping clients navigate through volatile market periods.

- Tailor your referral campaign messaging to what’s happening in the markets.

People will have questions and want to make changes during market swings. Market volatility creates the perfect opportunity for your referral campaigns. Ask your clients if they or somebody they know would a 15 minute complementary consultation with portfolio review- even accounts you don’t manage.

Financial planning is about more than just good advice or investment returns. It’s about providing guidance that you can trust.

In conclusion, communicating with clients during market volatility is an important part of your job. You can be a valuable resource for them by keeping them abreast of the current state of affairs and providing them with insights into how they can best protect themselves against uncertainty in the future.

Contact us, we will help you create a winning strategy to reach and educate your perfect client.